Case studies

Alma Deals & Conseil supports you in every type of operation by implementing a tailored process that ensures dynamism and efficiency.

History

- 2 founding leaders in Paris (Mr. Bensignor and Mr. Armelin)

- Growth in Paris and creation of a subsidiary in Lille

- Mr. Bensignor wishes to settle in Nice

- Organizational change and continued growth

- More rapid development in Lille than in Paris

Context

M. Bensignor desires to sell to increase his assets. Mr. Armelin seeks to change professions, while the partner in Lille (Mrs. Taffin) desires to remain.

Our advice

- Search for buyers with a strong presence in Paris and no presence in Lille

- Search for client portfolios in banking and insurance

- Very promising acquisition market: strong HR issues

- Mrs. Taffin staying on is very advantageous for valuation and the sustainability of the company

Objective

Backing a Industrial Actor

Advantages

- Continue its development

- It can rely on the acquirer’s back office for sourcing

- It can manage the acquirer’s clients through the ARBEN NORD subsidiary

For Ms. Taffin, her 10% stake may be worth a lot more in the future.

- Existing Know-How

- Value Creation

- Operational Synergies

History

Created in 1475, LA ROCHERE glassworks is the oldest traditional art glassworks in activity in Europe. The company works 60% for table arts and 40% for architectural building.

Context

The leader is 82 years old and has not found a family successor to take over the company. LA ROCHERE managed to maintain its business in 2020 despite the crisis. The company is operating at a loss and is in a financially precarious situation.

Objective

To ensure the transmission and sustainability of LA ROCHERE so that this historic company can continue its activity.

M&A Tips

The Tourres family, as an old family of glassmakers, appeared as the most natural buyers in the eyes of the CEO. Seven executives from the company invested capital with the buyers. The new management of the company will be supported by the establishment of a strategic committee. Status of the mission: Mission completed with receipt of funds in February 2021. Operation details: value of securities: €500,000. A capital increase of €1,000,000 will allow the Tourres family to finance significant investments.

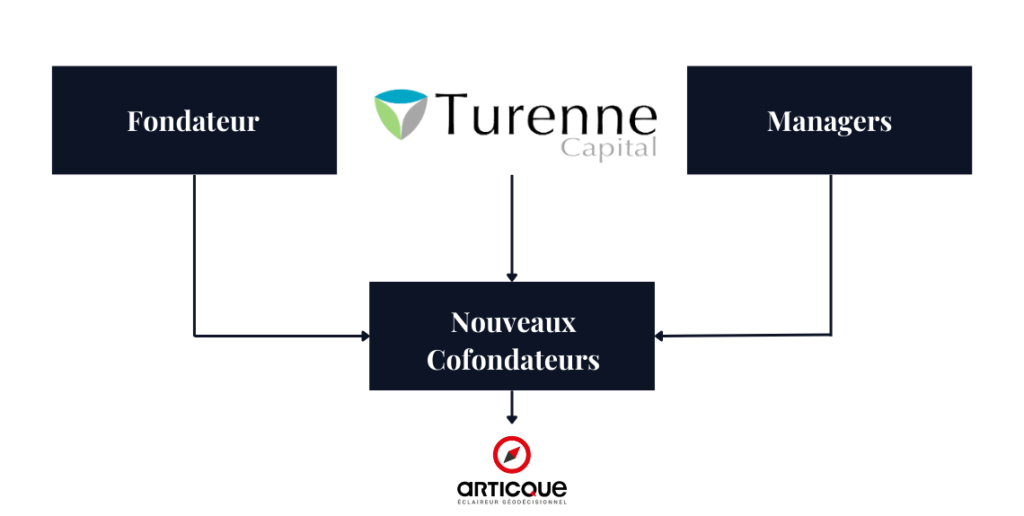

History

ARTICQUE is a company that specializes in developing software for the field of geomatics. It’s a rapidly expanding enterprise that is currently encountering obstacles in the recruitment of sales personnel.

Context

- 2018: First positive year with an EBITDA of €1M excluding immobilized production

- The CEO is 63 years old and wants to prepare for the transfer of ownership

- Time to market product

- Increase in prospects and customers

Objective

Accelerate development in France and internationally through organic growth, taking advantage of a high-potential market. Also monitoring external growth opportunities.

Conseils M&A

Two alternatives were proposed to the client: Sell immediately or raise funds and sell in 3 years.

The valuation estimated to be €10 million if the client decides to sell immediately is the first option proposed.

The second option is to achieve an EBE of around €4 million over three years and an estimated valuation of €40 million.

- After discussing with several investors, the company’s director prefers TURENNE CAPITAL.

- The mission status is marked as completed with fund collection within the company beginning in April 2020.

- The details of the operation include a cash-in of €1.3 million in which €800,000 is in capital and €500,000 is in convertible bonds.